Music product trade magazine JAPAN MUSIC TRADES

JMT Web NewsINDUSTRY TOPICS

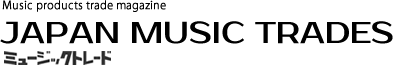

“Musical Instrument Stores' Grand Prize 2023” vote by Music Store Sales Staff

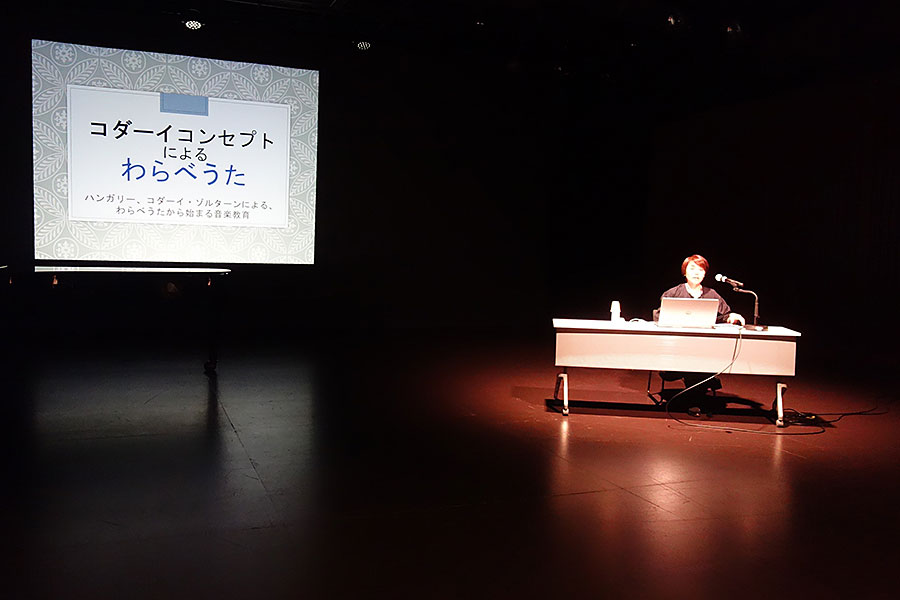

Musical Instrument Stores' Grand Prize 2023 recipients and products voted by music store sales staff throughout Japan and general music fans were announced on October 23. Japan Musical Instruments Association (JMIA) started the project in hopes of promoting music making and helping support music retailers 3 years ago. It has become an annual all-industry program.

This year 5 Products, 6 Artists and one Music-related Production categories were open for entry, and 3,346 music store sales staff and 29,799 general music fans voted.

The grand prix awards winners:

Products

*Digital Piano & Electronic Keyboard: Casio Privia PX-S7000 digital piano

*Flute: Muramatsu HANDMADE DS MODEL flute

*Guitars: Yamaha PACIFICA611VFM electric guitar, and Yamaha BB Series electric bass

*Violin: Eastman VL80 violin

2nd place winners:

Digital Piano & Electronic Keyboard: Kawai CA401 digital piano, Flute: Muramatsu flute HANDMADE EX MODEL, Guitar & bass: Yamaha PACIFICA112V, Yamaha TRB/TRBX Series, Violin: Gliga/Gliga Gems

3rd place winners

Digital Piano & Electronic Keyboard: Yamaha Clavinova CLP-775, Flute: Yamaha YFL-517 professional flute, Guitar & bass: Epiphone Les Paul Custom/Ebony, Bacchus Global Series-WL4-STD/RSM

Music-related Production

*Bocchi the Rock! (a serialized anime comic)

2nd place winner: BLUE GIANT (anime comic)

3rd place winner: Ao-no Orchestra (Blue Orchestra, anime comic)

Artists

Takuma Ishii (Takuon, piano), Kaho Iwasaki (flute), Ayasa (violin), Marco (Yome-to-Ore, guitar), Hama Okamoto (Okamoto’s, bass), Ryo Kanda (drums)

Comments of the manufacturers of the awarded products

“It’s a great honor that Privia PX-S7000 won the 2023 Grand Prix award. We developed the instrument under a new product concept, ‘lifestyle piano.’ It’s a digital piano with exceptional quality in design and functions. A host of business partners including Hayato Sumino, Privia Ambassador kindly sent us warm words of congratulations.”

Yoshinori Kawai, Senior General Manager, Domestic Sales Division, Global Marketing Headquarters, Casio Computer Co., Ltd.

“We appreciate very much that Muramatsu HANDMADE DS MODEL received the 2023 Grand Prix Award. It’s a standard type drown hole silver flute, but we have built it with exceptional mechanism and the best conceivable pad placement technique to maximize tonal advantages of the instrument.”

Akihiro Urano, Director, Sales General Manager, Muramatsu Inc.

“As live concerts return, and the popular animation movie inspired the interest in playing guitar, demands of electric guitar increased especially among senior high-school students. We are proud that Yamaha PACIFICA611VFM was chosen as the best instrument by the music store sales staff.

“It’s a middle class instrument, a little expensive than entry models with rich specifications exceeding price.

“BB Series has been the principal line of Yamaha basses supported by top artists for more than 40 years. They are filled with the thoughts of the developers and have continuously progressed serving the needs of the times. We really appreciate the support of the music store sales staff.”

Takashi Tasaka, Division Manager, LM Division, Yamaha Music Japan Co., Ltd.

“We are very excited that the honorable 2023 Grand Prix Award was given to Eastman VL80. Our major object has been to increase as many violin players as possible in the last 25 years. It’s great to share the honor with craftsmen team at Eastman.”

Kenzo Hayashi, president, S. I. E. Co., Ltd.

December 2023 New Products Launch

Yamaha P-525B, P-525WH digital pianos

https://www.yamaha.com/ja/news_release/2023/23101901/

Korg modwave mkII synthesizer

https://www.korg.com/jp/products/synthesizers/modwave_mk2/

Pearl MIDTOWN Series MT564/C-D drum set

https://www.pearldrum.com/ja/products/drum-sets/midtown-series/midtown-series/

Pearl Eliminator Redline Transport “LT” drum pedal with anello pack

https://pearldrum.com/ja/drums-news/53003496/

DW DWe convertible drum set

https://www.dwdrums.com/dwe/

Korg MPS-10 Drum/Percussion/Sampler Pad

https://www.korg.com/jp/products/drums/mps10/

ESP BanG Dream ULTRATONE Anon, POTBELLY FM Rana, POTBELLY PM Rana, GB Soyo electric guitars, ESP S-70 MyGo!!!! guitar strap

https://espguitars.co.jp/collaborate/33185/

O.Z.Y SNAPPER TAKMIY Custom electric guitar

https://espguitars.co.jp/artists/3311/

Edwards E-SNAPPER TO Eclipse Gold, E-SNAPPER TO Royal Silver electric guitars

https://espguitars.co.jp/artists/3451

Line 6 HX-One effect pedal

https://line6.jp/hx-one/

Boss DS-1-B50A, SD-1-B5OA, BD-2-B5OA 50th Anniversary effect pedals

https://www.boss.info/jp/boss-50th-anniversary/

Boss RV200 effect pedal reverv

https://www.boss.info/jp/products/rv-200/

Steingerg Cubase Pro 13, Artist 13, Elements 13 music production software

https://www.yamaha.com/ja/news_release/2023/23110601/

Steinberg Nuendo 13 DAW software

https://www.yamaha.com/ja/news_release/2023/23111601/

Yamaha VOCALO CHANGER PLUGIN

https://www.yamaha.com/ja/news_release/2023/23101801/

Korg Keystage MIDI controller

https://www.korg.com/jp/products/computergear/keystage/index.php/

Korg KAOSS Replay stand-alone performance tool

https://www.korg.com/jp/products/dj/kaoss_replay/index.php/

Yamaha HS4-/HS4W, HS3/HS3W studio monitors

https://www.yamaha.com/ja/news_release/2023/23111501/

ESP PA-GS15SD-20thguitar pick

https://espguitars.co.jp/productinfo/35016/

STELLA GEAR SG-P-LikeanAngele2023 guitar picks

https://espguitars.co.jp/productinfo/35018

Righton strap

https://www.kikutani.co.jp/itemlist/43859/

Pearl with anello stick bags and crossbody bags

https://pearldrum.com/ja/drums-news/5300349/

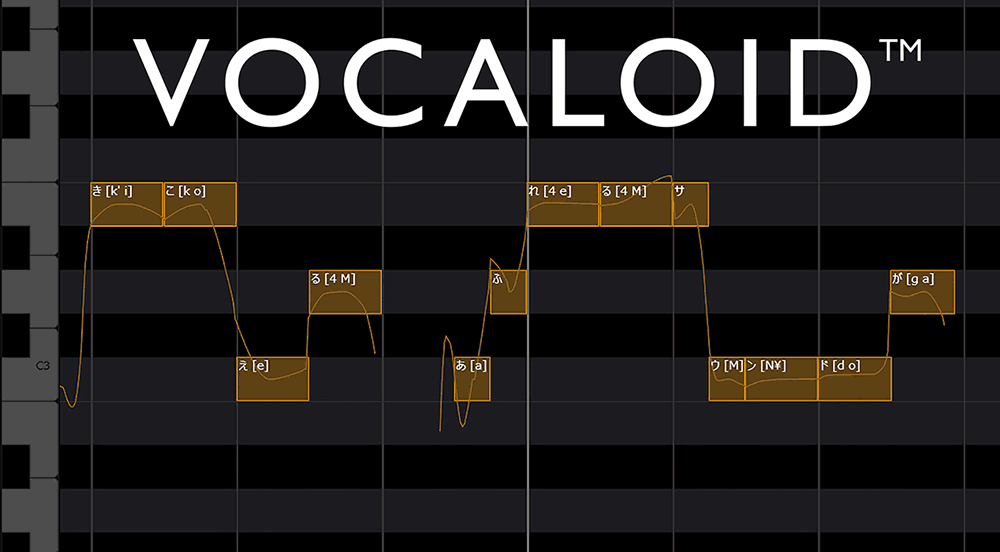

Roland Constructs New Headquarters Bldg. in Hamamatsu

Roland announced that the company would commence construction of a core R & D facility in Hamamatsu where its headquarters are located in August 2024.

Roland has expanded development and manufacturing facilities in Hamamatsu and delivered a host of Roland innovative digital music products to the world markets since 1973. In 2005, the company decided to move its corporate headquarters from Osaka to Hamamatsu (Hosoe factory) to continue business as a manufacturer based in Hamamatsu.

The construction plan is an expansion of Shin-Miyakoda production base efficiently connecting the existent 2 buildings to make it a circular structure with Roland Circuit including an atrium, and Roland Arena at the center used for multi purposes. The new structure contributes to save construction resources and provides the company employees with upgraded work environment as well as flexibility, and sustainability of the entire facilities.

The new headquarters building will accommodate Roland’s every R&D division under one roof now located in several factories in Hamamatsu area.

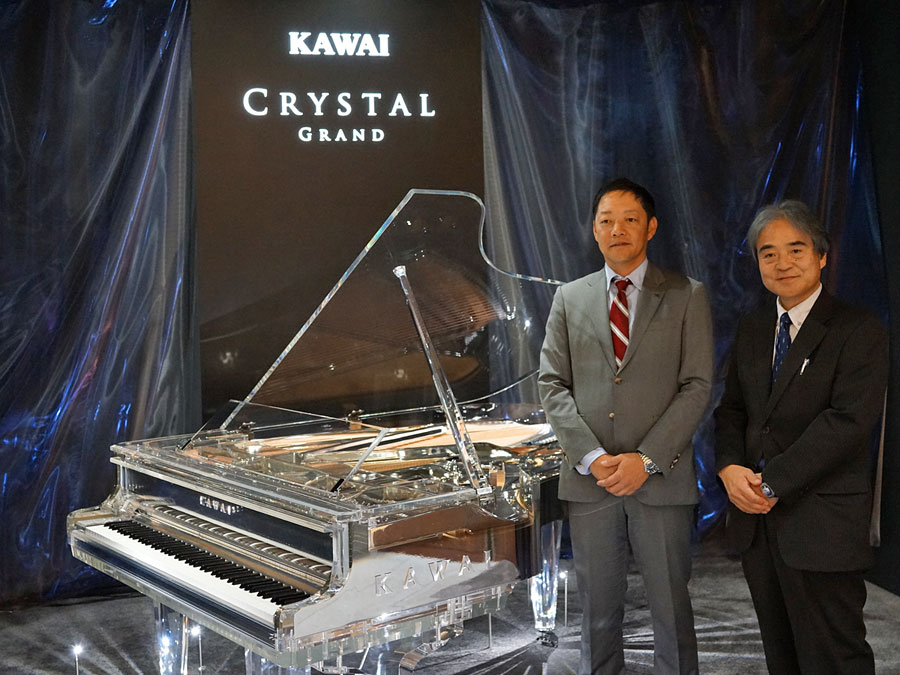

Kawai Europe Opens Subsidiary in Poland

Kawai announced that it had opened a subsidiary in Warsaw, Poland on September 1. So far, the company distributed Kawai products through a local import agent. Kawai expects to strengthen marketing of Kawai pianos for academies, music schools and Kawai artists through the own subsidiary.

Warsaw has a rich musical tradition and is known as the place where Chopin International Piano Competition, one of the three major piano competitions in the world takes place. Kawai Warsaw subsidiary has a 120-seat concert hall in addition to a spacious showroom where broad line-up of Kawai pianos including Shigeru Kawai flagship models are displayed.

Yamaha Music Japan and Yamaha Music Retailing Merge

Yamaha announced recently that Yamaha Music Japan and Yamaha Music Retailing, domestic distribution and retailing companies would merge on April 1, 2024.

It’s part of the corporate transition program changing domestic distribution and retail units to an integrated business connecting Yamaha dealers, direct shops, and music studio operation providing customers with products of eminent brand and uncomparable shopping experience.

The business integration is also expected to bring much improved marketing and overall operation by consolidated human resources and established business know-hows under one roof, and flexible response to changing social environment and customer needs.

November 2023 New Products Launch

Bösendorfer Tree of Life grand piano

https://www.yamaha.com/ja/news_release/2023/23100401/

Kawai CA901A digital piano

https://www.kawai.jp/product/ca901/

Yamaha MONTAGE M6, M7 &M8x synthesizers

https://www.yamaha.com/ja/news_release/2023/23101002/

Roland GAIA 2 synthesizer

https://www.roland.com/jp/products/gaia_2/

Osawa BC Triplet I ocarina

https://www.prima-gakki.co.jp/catalog/osawaocarina/

Pearl Crystal Beat 50th Anniversary Limited Edition drum set

https://pearldrum.com/ja/drums-news/53002916/

ESP Jimmy CAT & Jimmy CAT-CTM electric guitars

https://espguitars.co.jp/productinfo/34541/

StellaGear GLAMBELLY GUITAR GOOD VIBES electric guitar

https://espguitars.co.jp/product/34377/

Zemaitis MFV22 electric guitar

http://www.zemaitis-guitars.jp/metal_front/mtv22_black.html/

Grass Roots G-AMAZE-DX/LS Pelham Blue electric bass

https://espguitars.co.jp/product/32207/

Blitz BLP-SPL/DC electric guitars

http://www.ariaguitars.com/jp/items/electric-guitars/blitz/

Kiwaya KCU-2C, KCU-2C/AG-uke, KTU-2C, KTU-2C/AG-uke ukuleles

https://www.kiwayasbest.com/shopbrand/ct454/

Boss KATANA-AIR EX guitar amplifier

https://www.boss.info/jp/products/katana-air_ex/

Steinberg UR22C RD, GN, UR44C RD, UR22C RD Recording Pack USB audio interface

https://www.yamaha.com/ja/news_release/2023/23101102/

Roland SP-404MKII Stones Throw Limited Edition sampler

https://www.roland.com/jp/promos/sp-404mk2_stones_throw/

Korg DC-P2-SMX dust cover for digital piano

https://www.korg.com/jp/products/accessories/dc_p2_smx/

Aria Pro II UGP-80-ULTRA GUITAR POLISHwww.ariaguitars.com/jp/items/accessories/care-spraycloth/guitar-polish/ugp80/

Casio Starts Crowdfunding for Manufacturing New Guitar Effect Processor

Casio Computer announced development of DIMENSION TRIPPER, a guitar effect processor to be put on guitar strap to alter guitar sound and is raising funds through GREEN FUNDING crowd funding site from October 12 through the end of November.

The company plans to raise 7.45 million yen asking supporters 35,200 yen per single set.

Wireless DIMENSION TRIPPER was developed by three Casio engineers/ guitar freaks, and it comes with a transmitter to be put on guitar strap and a receiver to plug with the effect processor.

While playing, guitarist can control effects level simply by pulling a spring of the transmitter put on the strap.

Coupled with foot-controlled volume pedal or expression pedal, guitarist can enjoy versatile tonal color not obtainable from conventional effects processor.

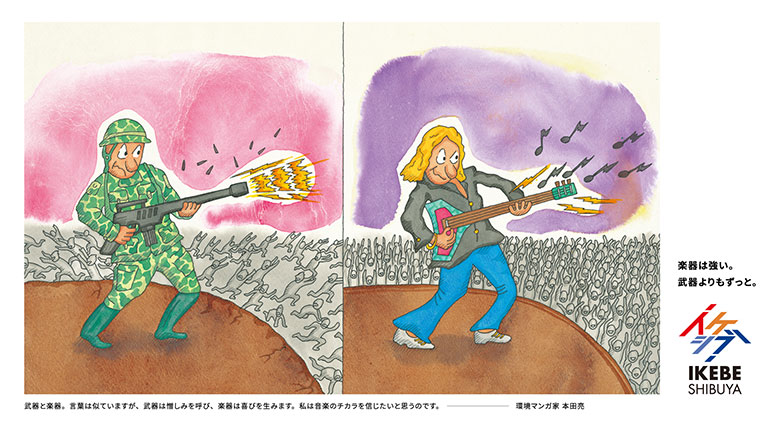

Ikebe Gakki Starts New Subscription Customer Service

Tokyo-based Ikebe Gakki Co., Ltd. announced that it had started a new and exclusive subscription style customer service named “Ikebe PRIME.”

Consisted of Ikebe Online Store, Ikebe Reuse and Ikebe Entertainment categories, the new service is provided at 1,200 yen monthly subscription (no charge for the first month after registration). The service gives customers of Ikebe Online Store 5 benefits; 1. Free shipping of goods, 2. 1% additional purchase points, 3. Additional 10% trade-in points at Ikebe Reuse, 4. Free view of Ikebe live events, instrument lesson and entertainment movies, 5. Advanced reservation rights for Ikebe events, workshops, seminars and customer exclusive events.

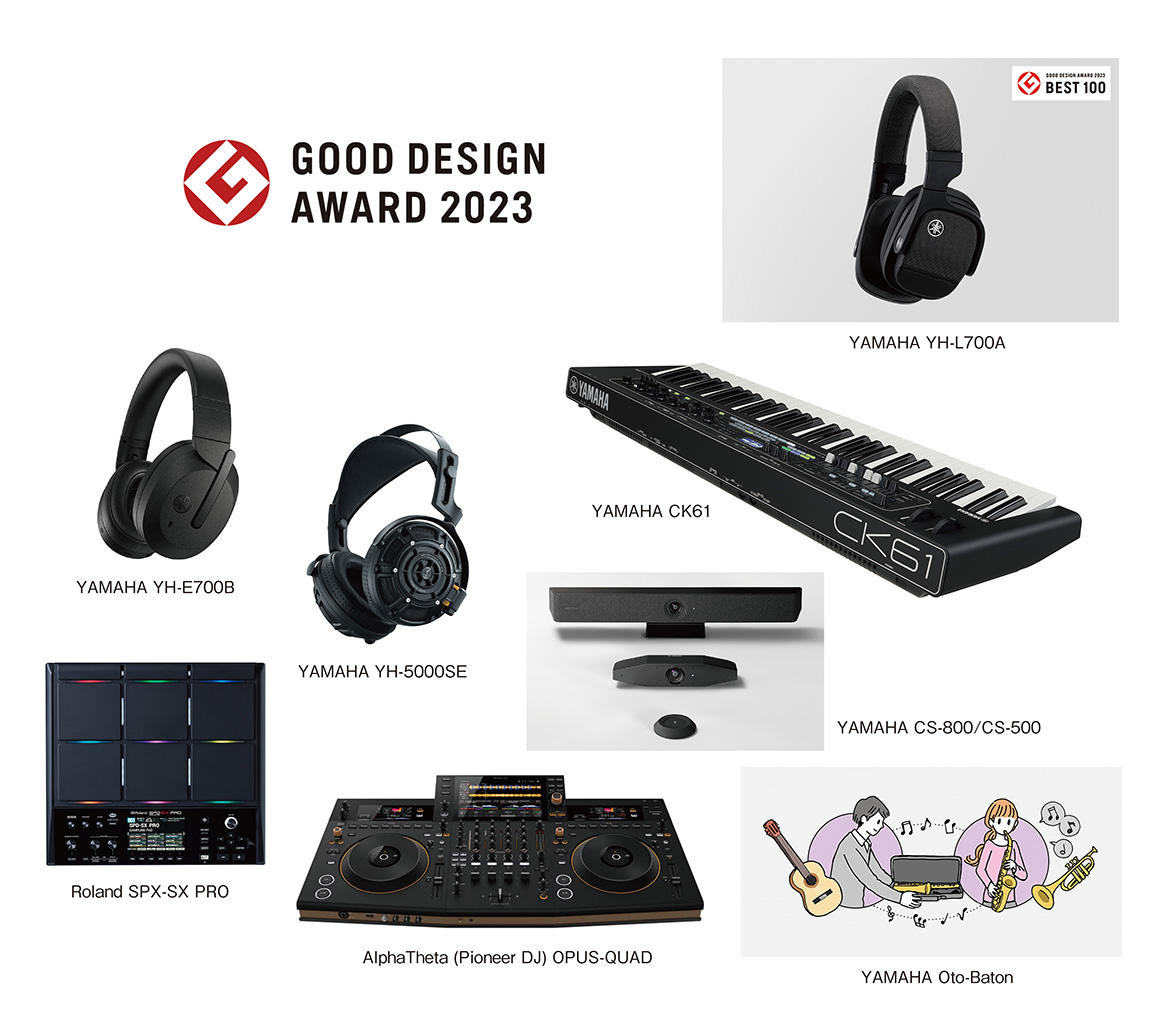

2023 Japan Good Design Awards

Japan Institute of Design Promotion announced recipients of 2023 Good Design Award.

From the music products industry Yamaha YH -L700A, YH-E700B and YH-5000SE headphones, CK61 stage keyboard, CS-800/500 video collaboration systems and “Oto Baton” (Sound Baton) musical instruments trade-in service, Roland SPD-SX PRO sampling pad and AlphaTheta OPUS-QUAD standalone DJ system were awarded.

Yamaha YH-L700A was chosen among Good Design100 Best 100 Products which are awarded to the products with higher design excellence.

Yamaha Music London Reopens

Yamaha Music Europe announced recently that Yamaha Music London, flagship store/showroom in Europe reopened on October 12.

Initially opened in 2007 on Soho, London, the store was reborn as a place where everyone from professionals to general music fans can experience Yamaha brands and pleasure of music repeatedly in Inviting, Inspiring and Experiencing environment.

The 1st floor invites non-music makers to casual atmosphere and experience equipped with a wide variety of entry models of Yamaha music products including the largest selection of digital piano in Europe. It also has a new AV gaming area to experience high quality Yamaha sound products, and an event site with a performance stage.

The basement was redesigned to an exclusive guitar floor showcasing 170 Yamaha guitars, and the second floor much favored for its classical photogenic interior design accommodates around 30 units of acoustic Yamaha and Bösendorfer pianos to experience their sound.

The store employs a new entry system using Yamaha Music ID, and provides visitors with a shooting booth for needs of posting their performance on social media.

In celebration of the reopening, the store held Disklavier remote live piano concert connecting Yamaha Ginza store and the London store online on October 6 delivering piano music played by 2 pianists.

Obituary

Tsutomu Hosokawa (1938 – 2023)

Tsutomu Hosokawa, founder, and consultant of Nagoya-based HOSCO Inc., distributor of acoustic and electric guitars, ukuleles, guitar parts and accessories passed away on September 10 at the age of 85.

Hosokawa launched Saga Japan as a Japan office of Saga Musical Instruments. U.S., in 1983, and the company changed the corporate name to HOSCO Inc. in 2007.

Shinji Hosokawa, son of Tsutomu now serves as president of the company.

October New Products Launch

Yamaha NU1XA、NU1XAPWH AvanGrand hybrid pianos

https://www.yamaha.com/news_release/2023/23091301/

Yamaha Disklavier ENSPIRE upgrade units

https://www.yamaha.com/news_release/2023/23083001

Kawai GP44 grand piano style miniature piano

https://www.kawai.co.jp/news/20230824/

Hammond M-solo 49-key drawbar keyboard

https://www.suzuki-music.co.jp/products/65791

Yamaha FGDP-50, FGDP-30 finger drum pads

https://www.yamaha.com/news_release/2023/23090501/

Killer KG-Fascist '23, KG-Fascist Vice Milky Way '23 electric guitars

https://www.killer.jp/guitar/kg-fascist-23.html/

https://www.killer.jp/guitar/kg-fascist-vice-milky-way-23.html/

Edwards E-MYSTIQUE electric guitar

https://espguitars.co.jp/productinfo/34019/

Grass Roots G-SN-CTM/P Blond electric guitar

https://espguitars.co.jp/product/34710/

Boss NS-1X noise suppressor

https://www.boss.info/jp/products/ns-1x/

ESP PA-LMidori10-2 (LOVEBITES/midori) guitar pick

https://espguitars.co.jp/accessory/11286/

ESP FES POUCH

https://espguitars.co.jp/productinfo/34086/

Nonaka saxophone case

https://www.nonaka.com/information/detail.jsp?id=62845/

Kiwaya HCK ukulele cases

https://www.kiwayasbest.com/shopbrand/ct372/

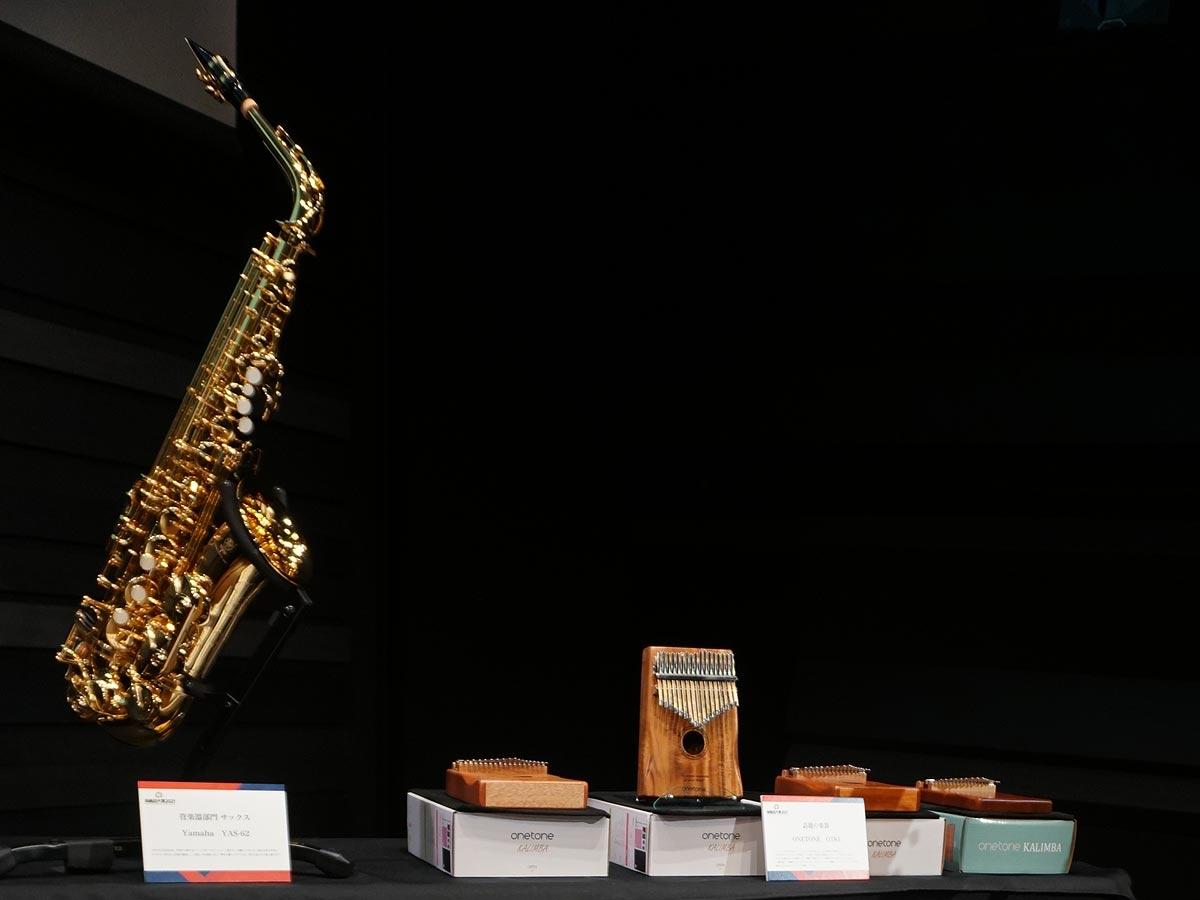

Tokyo Gakki (Musical Instruments) Expo 2023 Takes Place in November

Tokyo Gakki ( Musical Instruments) Expo Steering Committee holds Tokyo Gakki Expo 2023, the first event providing visitors of all age groups with musical experience to increase music making population on November 11 and 12 at Kitanomaru Science Museum under patronage of Japan Musical Instruments Association. Japan Synthesizer Professional Arts provides management and production services of the events.

The first-time music makers are encouraged to experience a wide range of digital musical instruments including synthesizers, DJ equipment, guitars and amps, effect processors, acoustic and digital drums offered by more than 30 manufacturers and distributors.

In addition to products presentation, the event offers workshops and live stage performance by professional artists.

The organizer expects to make it an annual event adding more music genres in coming years.

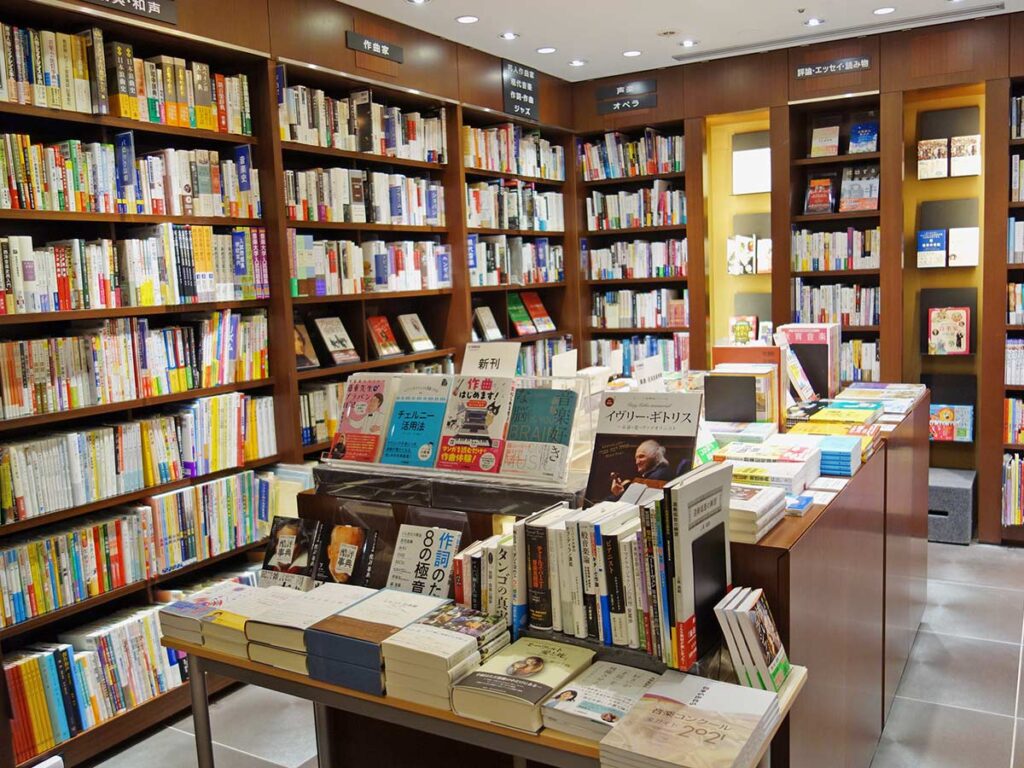

Yamaha Opens Music Experience Brand Shop in Yokohama

Yamaha Corporation, Yamaha Music Japan Co., Ltd. and Yamaha Music Retailing Co., Ltd. opens Yamaha brand shop of which official name will be announced later at Yokohama Sympho Stage Minato Mirai21 to be completed in March 2024.

Sharing about 2,600 sq. meter space on 1st, 2nd and 3rd floors of the site, it provides brand experience space equipped with a large screen and Yamaha and Bösendorfer piano showroom on the 1st floor. The 2nd floor is allocated for every type of musical instruments ready to experience, printed music and books as well as a café with a small stage for live performances. There will be music lesson classes for adults and a music salon. (floors images: 2nd floor, top and lobby area on the 3rd floor.)

In line with the opening of the new brand shop, Yamaha Music Yokohama, Music Avenue Yokohama, Yamaha Music Pianoforte Kami-ohoka and Bösendorfer Tokyo Showroom will be closed 2024 Spring, and retail businesses, piano showroom and music lesson studios will be transferred to the brand shop.

eBay Music Products Marketplace Grows

Growing demands for Japan brands

eBay recently announced that its marketplace for musical instruments was quite busy attracting buyers. It says that musical instruments business significantly increased as people spent more time and money for music making at home during the recent pandemic. The musical instruments market grew 50% from the pre-pandemic days and continues to grow.

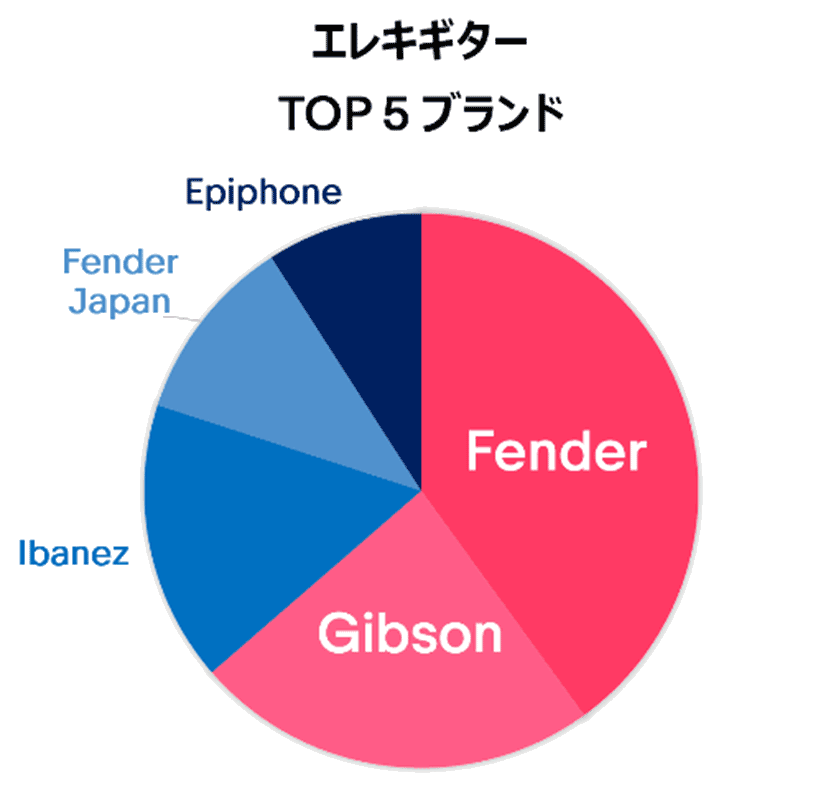

From 80,000 to 100,000 musical instruments and related accessories are regularly listed on the eBay marketplace. Electric guitars are particularly popular, and demands are further growing for vintage, out of production models and replicas of name guitarists.

U.S. made guitars are much sought after, but some buyers in U.S like to buy guitars listed by Japanese sellers, as they say, “Goods listed by Japanese sellers are in better conditions”, or “The goods are sent from Japan in much sturdy shipping package.” (graph right: high demands for 5 electric guitars)

Acoustic guitars constantly sell well as demands continue for entry level acoustic guitars. It’s supposed that young consumers bought inexpensive acoustic guitars during the pandemic and now sell them on the marketplace.

DJ machines are also selling well. They are bought as interior objectives, and 2022 sales doubled over the previous year. Such Japanese brands as Pioneer, Technics, Vestax and Denon are much favored. Because they are largely high-ticket models, current exchange rate of Japanese yen against U.S. dollars contributes to boost sales of them.

JMIA Completes 2022 Music Products Production (Sales and Export) Survey

JMIA (Japan Musical Instruments Association) sent a questionnaire to 84 manufacturers throughout Japan for the 2022 Survey and 54 of them participated sending back data online. Japan Music Trades complied the data and completed the following report adding commentary.

2022 Production significantly increased in value

The survey shows export value of keyboards, percussions, guitars, and digital musical instruments dramatically increased. The largest difference in comparison with the 2021 data was that the manufacturers reported export value far surpassed unit sales in many product categories. Among the 70 reported categories, in 24 categories, export value exceeded unit value over the 2021 survey in which only 7 categories were reported.

It’s largely attributed to the actuality that the manufacturers raised price of products in the last one or two years. Also, U.S. dollar strengthened against yen helped contributed to increase their revenue. In 2021 exchange rate of yen against US dollar was between 110 yen and 115 yen. A year later, yen significantly went down to the range from 130 yen to 140 yen. In October last year, yen further dipped to 150 yen, the lowest level in the last 32 years.

On the other hand, Japanese manufacturers were hardly hit by hike of transportation, energy cost and raw materials and parts caused by soaring oil price. That means increased revenue was offset by weaker yen. Currency trend continued after this past April, export increase seems to last into 2024.

Sound domestic sales of acoustic piano

Export and domestic sales of acoustic upright, grand and automatic player pianos increased 8% to 70 billion yen in 2022. Export and domestic sales of digital piano also went up 14% to 92.9 billion yen. Total piano sales shared 45%, the largest of all categories.

Last year 13,077 units of acoustic piano, a 9% increase over the previous year were sold in Japan with total sales of 7.8 billion yen, a 10% increase which exceeded 2019 before the pandemic sales.

Domestic acoustic piano sales included 9,744 upright pianos (+11%) and 3,276 grand pianos (+3%). Domestic sales and export of grand pianos and automatic player pianos increased between 5% and 60%, but upright pianos declined both in the domestic market and export by 4% and 17%, respectively. Export unit of upright pianos also decreased but increased in value.

182 thousand units of digital pianos, 16% fewer than the year before last were sold in Japan with total value of 13.4 billion yen, a 10% decrease. While export of digital pianos went down 11% to 1,358 thousand units, the total value gained 20% to 79.5 billion yen.

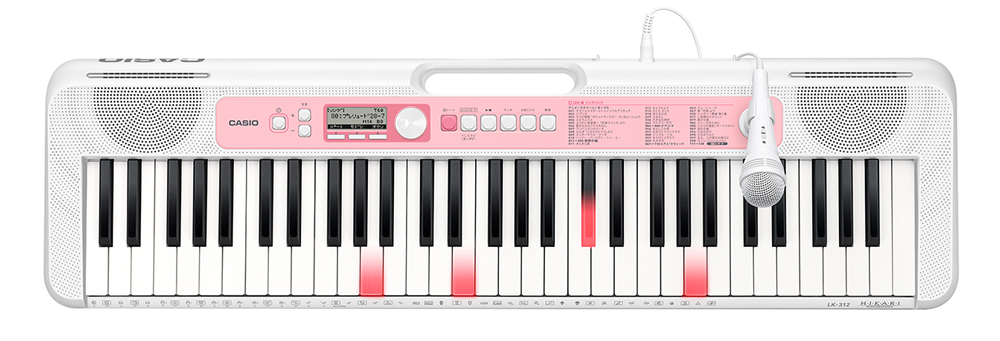

Domestic sales of electronic keyboard increased 21% to 192 thousand units as seniors became interested in the instruments again. Total value jumped up 35% to 3.1 billion yen.

Domestic sales of automatic player pianos and digital pianos went down in value last year.

Dramatic increase of wind instruments export

Total domestic sales and export of wind instruments achieved 35.5 billion yen and shared the largest 10% of the total categories. They increased 23% to 397 thousand units and 32% in value. The unit sales nearly recovered 400,000 units recorded in 2019.

Domestic sales increased 9% in value over the year before last, but unit sales declined 1% to 42,000 units.

Despite the instruments of almost all categories have not yet recovered the pre-pandemic level in unit, saxophone sales doubled to 19,000 units, the largest increase in the past 8 years gaining 1.89 billion yen, a 35% increase. It looks that exceptional demands for entry-level models from students and adults pushed up the unit sales.

Export of woodwind and brass instruments considerably increased in unit from 13% to 31% and from 2% to 67% depending on items, respectively. They also increased in value from 30% to 60%. As far as unit sales are concerned, wind instrument sales have about returned to the pre-pandemic level.

Domestic sales of violin and family instruments gained modest 2% to 300 million yen, but unit sales declined 14% to 4,017 units. Domestic production of other stringed instruments including mandolins, banjoes and harps increased astonishing 151% in unit and domestic sales gained 193% in unit last year. Since this category showed extraordinary discrepancies during the last couple of years, it’s not easy to find the real market conditions from the unit price and year to year comparison of data.

Percussions achieved 3 consecutive years of growth

Domestic sales and export of percussions increased 22% to 27.9 billion yen which was 3-consecutive years of growth after the record sales in 2016. Domestic sales increased 4% to 3.7 billion yen, and export gained 25% to 24.2 billion yen. As shown on many other product categories, sales increase in value exceeded that of unit sales over the year.

Categories with increased domestic sales included, drum sets (7%) educational percussions (9%), cymbals (13%), sticks and mallets (75%) and other percussions (59%).

Export of marching drums rose 54%, educational percussions 181% and other percussions 83%. All tells that business of these items were excellent and recovered near or even higher level of pre-pandemic.

Sales of electronic drum sets which shared 35% of total percussions have slowed down as the dynamic surge of demands during the stay-at-home times waned. Export of them went up 7% in value but declined 20% in unit. Domestic sales of them went down 30% in unit and 21% in value.

Export of other electronic percussions which shared 14% of the total percussion increased 16% in unit and 104% in value. Domestic sales of them decreased 13% in unit, but value wise increased 20%.

Sales growth of electric guitar continued

Total sales and export of acoustic guitars, electric-acoustic guitars, electric guitars & basses, amps, effect pedals, tuners and strings marked 63.8 billion yen sharing 18% of total categories.

The frenetic demands for acoustic and electric-acoustic guitars continued from 2020 to 2021 diminished, domestic sales and export of acoustic guitars declined 33% and 35% in unit, respectively. Though domestic sales of electric-acoustic guitars decreased 10%, and export dropped 25% in unit, they maintain demands during the pre-pandemic period.

Last year 586,000 electric guitars and basses, the same level over the previous year were exported. Domestic sales of them decreased minimal 3%. Given that the 2021 sales far exceeded that of 2020 (export and domestic sales increased 37% and 137%, respectively), it’s safe to say that the category kept excellent performance when compared with the 2019 pre-pandemic sales.

The 2022 growth was partly attributed to the soared demands for entry level guitars from the year end through last spring inspired by a popular TV animation program.

The data shows that domestic sales of guitar and bass strings increased 720% to 680 million yen despite the unit sales didn’t much change from the year before last. This incredible growth may reflect some leading manufacturers of expensive guitar and bass strings newly participated in the survey or, there is a possibility that one or more manufacturers only reported domestic sales, excluding export data because average export unit price in 2022 almost remained the same as 2021.

Reed instrument sales followed trajectory of recovery

Domestic sales of other musical instruments including reed instruments, recorders, ocarinas and Taishokotos slightly surpassed the pre-pandemic performance. Export of harmonicas increased 52% and domestic sales jumped up 130%. Export of melodicas also increased 172%, while domestic sales decreased a marginal 2%. Sales of accordions returned to the level before the pre-pandemic times. Also, recorders nearly achieved the level before 2019 both in domestic sales and export.

Domestic sales of synthesizer exceeded 2021 level

Sales of synthesizers with keyboard and other electronic musical instruments increased 37% in value but decreased 9% in unit. Export of them went up 35% and 50% in value, respectively. Domestic sales of synthesizer with keyboard increased 8% in unit but decreased 1% in value. Domestic sales of synthesizer with keyboard increased 8% in unit from, but value declined 1%.

Export and domestic sales of other electronic musical instruments decreased between 12% and 22% depending on product lines in unit but in value they increased between 37% and 50%.

Export of easy-to-use PA system expands

Live musical events got back in 2021, demands for PA system grew. In 2022 export of easy-to-use PA and speaker systems dramatically advanced. On the other hand, export and domestic sales of power amplifiers significantly dropped both in unit and value. It’s likely that fewer manufacturers participated in the 2022 survey rather than demands diminished.

To the contrary, production and sales of cabled microphones, digital MTRs, portable digital recorders, sound cards & related hardware substantially increased. Like the PA system, it looks there developed a major change in data base of manufacturers making these lines.

September Products Launch

Casio LK-530, LK-330 electronic keyboards

https://www.casio.com/jp/electronic-musical-instruments/product.LK-530

https://www.casio.com/jp/electronic-musical-instruments/product.LK-330/

Pearl ”Sumikko-gurashi” drumset and drumsticks, New Japan Pro Wrestling-collaborated special drumsticks

https://pearldrum.com/ja/drums-news/53002716

https://pearldrum.com/ja/drums-news/53002746

Nakano 923 Type Dr. Yellow xylophone

https://nakano-music.co.jp/products/tc-c923dy_xy/

ESP FRX-CTM FM electric guitar

https://espguitars.co.jp/productinfo/33679

Legend LST-AZ, LTE-AZ, LJB-AZ electric guitars and bass

http://www.ariaguitars.com/jp/items/electric-guitars/legend/

Boss AC-22LX acoustic amp

https://boss.info/jp/categories/amplifiers/acoustic/

Boss AC-22LX acoustic amp

https://boss.info/jp/categories/amplifiers/acoustic/

Aria Pro II SPS-2400Cn, SPS-2400NF guitar straps

http://www.ariaguitars.com/jp/items/accessories/strap/

ESP PA-LT10-LikeanAngel (tetsuya) picks

https://espguitars.co.jp/accessory/9211/

Pearl ANL-FLB2 anello-collaborated flute bag

pearl_flutecatalog_2023_web.pdf (pearl-music.co.jp

Liveline LS2400FL7, LS2400CAT4, LSB45MK guitar straps

http://www.tmc-liveline.co.jp/liveline/50mm.html#ls2400/

Memorial Ceremony for Manji Suzuki, Founder of Suzuki

Suzuki Musical Instrument Manufacturing Co., Ltd., manufacturer of Suzuki melodicas, harmonicas and wide array of educational musical instruments held a memorial service for the company’s founder Manji Suzuki, who passed away August 2020 on July 27 at Okura Actcity Hotel Hamamatsu.

Around 600 business partners, Suzuki artists, employees of Suzuki and its group companies were greeted by a sizable Suzuki Melodion beautifully arranged with a lot of flowers and a photo of Manji Suzuki holding a Suzuki harmonica.

The mourning ceremony was followed by video showing of the memories of Manji.

Born in 1923, little boy Manji was enthralled by harmonica. Later in 1938 he got a job at Kawai and learned making harmonica. He left Kawai in 1953 to start making harmonica himself and launched Suzuki Musical the next year.

His business successfully expanded as export demands for harmonica grew, and the instrument was adopted for entry level music education by Japanese government in 1958.

Manji developed Suzuki Melodion Super 34, first melodica manufactured in Japan in 1961 to meet the needs from music teachers who felt difficulty in teaching harmonica in class. Melodica was approved by its excellence in music education in the ensuing years. It was named as an official instrument for the Course of Study.

Suzuki Musical has expanded businesses launching distribution, export, development and production of educational music software units as well as manufacture of Hammond Suzuki electronic organs in Japan and overseas to today.

After live sessions by Suzuki artists, Hirotaka Kawai, Chairman/President of Kawai Musical Instruments Mfg., Co., Ltd. and Masato Horibe, President of Niimi Gakki Co., Ltd. (distributor) delivered eulogy. Also, a video message by Stevie Wonder, who plays Suzuki harmonica was shown.

Ms. Reiko Suzuki, daughter and president of Suzuki thanked all participants saying, “My father devoted his life to making high quality attractive musical instruments. He spent truly a happy life, I believe. We are convinced that we follow his spirit and creed to deliver products loved by music makers.”

August Products Launch

Yamaha P-series P-S500B/WH, P-225B/WH, P-145B digital pianos

https://www.yamaha.com/ja/news_release/2023/23070701/

Korg NAUTILUS AT synthesizers

https://www.korg.com/jp/products/synthesizers/nautilus_at/

Korg opsix SE, SE Platinum Altered FM synthesizers

https://www.korg.com/jp/products/synthesizers/opsix_se/

Canopus “Kodachi” Toshiki Hata signature drumsticks

https://canopusdrums.com/jp/product/signaturestick/

LTD GH-600, GH-SV Gary Holt signature electric guitars

https://espguitars.co.jp/products/ltd

Edwards E-ALEXI BLACKY Alexi Laiho signature electric guitar

https://espguitars.co.jp/products/edwards/

Edwards E-LP-CTM /P Cherry electric guitar

https://espguitars.co.jp/productinfo/31645/

Aria Pro II 714-BLACK electric guitar

http://www.ariaguitars.com/jp/items/electric-guitars/714/714black/

Aria Pro II 615-BLACK electric guitar

http://www.ariaguitars.com/jp/items/electric-guitars/615/615black/

Aria Pro II STB-BLACK electric bass

http://www.ariaguitars.com/jp/items/basses/stb/stbblack/

BOSS GK-5 divided pickup

https://www.boss.info/jp/products/gk-5/

BOSS GK-5B Divided pickup

https://www.boss.info/jp/products/gk-5b/

BOSS GM-800 guitar/bass synthesizer

https://www.boss.info/jp/products/gm-800/

BOSS ME-90 multi-effects processor

https://www.boss.info/jp/products/me-90/

BOSS DM-101 delay machine

https://www.boss.info/jp/products/dm-101/

Pearl LL-FLT1(MGIV) tote bag

https://pearl-music.co.jp/flute/producs/6008

TMC Liveline LS2400CAT3, YUS38B-5, YUS20CAT3 guitar and ukulele straps

http://www.tmc-liveline.co.jp/

Ibanez P1000PGSP, 1000PG-YE picks

https://www.ibanez.com/jp/products/model/picks/

Roland Store Tokyo Opens in Jingu-mae

Roland opens second Roland Store in Jingu-mae, close to fashionable Harajyuku shopping spot in Tokyo on October 1. The company launched the first Roland Store in London in 2022.

Roland Store provides visitors with musical experience which inspires their musical creativity and supports them enjoy life with music. Roland Product Specialists are stationed at the store located in one of the trendy districts in Tokyo to provide them with solutions matched to their personal needs face to face in a setting of professional stage and lighting. Online appointment is required.

Based on Roland Store concept, Roland Store Tokyo focuses on offering visiting individuals experiences of Roland digital products in state-of-the-art environment, pleasure of creating music and enjoy music making lifetime. The 2-story and a basement building showcases Roland’s hot-ticket items. Gordon Raison, CEO and Representative Director of Roland commented, “We are pleased to announce launch of Roland Store Tokyo on October 1. Founded in Japan more than 50 years ago, Roland has played a key role in the music scene with innovative products and attracted musicians and music enthusiasts throughout the world. Roland Store Tokyo is not Roland’s direct retail outlet, but it stands as a most fantastic place where visitors can experience Roland brand. We will never be happier if the store is recognized as a spot that supports musicians and their music life with our products developed from creative and innovative ideas.

Roland Store Tokyo Jingu-mae 4-25-37, Shibuya-ku, Tokyo 150-0001

Fender Flagship Tokyo Opens: Providing Every Music Maker with Unprecedented Musical Experiences

Fender Musical Instruments and Fender Music opened the world’s first flagship store in its 77 years history in Harajyuku, one of the most trendy shopping districts in Tokyo on June 30.

The brand-new building with 3 floors and 1 basement already attracts fashionable music makers from and far out of Tokyo. An opening ceremony took place on the first day inviting media members and renowned Fender artists including Ken of L’Arc~en~Ciel, J of LUNA SEA, MIYABI, Soichiro Yamauchi of Fuji Fabric.

Andy Moonie, Fender Musical Instruments CEO said in his opening remarks, “Leo Fender once told "Artists are angels, and our job is to give them wings to fly." Our true task is offering every artist wings regardless of gender, genre and country they were born and grew. Right before the Covid-19 pandemic, annual sales of Fender musical instruments were 500 million U.S. dollars. Four years later, we have grown with sales of nearly 1,000 million U.S. dollars. Asia, the fastest growing market is expected to be the world’s largest in coming 10 years. We see Tokyo can serve as the most influential market and are pleased to have opened Fender Flagship in Harajuku. The store opens a door to new age and will surely contribute to bring further growth to the music products industry.

He continued saying, “During the years of self-confinement, 30 million people started playing guitar. If 10% of them keep playing guitar through life, the industry can expect 30-billion-dollar sales in 10 years. Those first-time guitar players are likely to get interested in upgrading their gears and thanks to them, sales of Fender guitars have increased to the highest level in our history.

“We feel humbled that the guitars with Leo Fender brand name are highly acclaimed for their innovative creativity after the first product was launched into the market more than 70 years ago, and the instruments are distributed through outstanding marketing at the flagship store just opened today with help of music retail channels in Japan.”

Edward Cole, president of Fender Music (Japan) which serves for Asian markets said, “Our concept is to support every level of players in their voyage of music. The flagship Tokyo store is built with this concept. We have continuously produced innovative products, carried attracting marketing approaches, intensified connection with artists and made efforts to increase players of every stage to this day. As a result, our sales in Asia & Pacific region have achieved 17% growth year after year.

“We chose Harajyuku (Tokyo) for the home of Flagship Tokyo from the following reasons; 1. A host of name international brands have flagship shops in Tokyo, 2. Influencers and brand-conscious consumers in Japan frequently visit Tokyo, 3. Japan has the largest and fastest growing music market, 4. More than 30 million tourists are expected to visit Tokyo this year, and the number is estimated to be doubled in 10 years to come, 5. International tourists love to visit world-class brand shops and enjoy exciting shopping experience offered by Japanese sales staff with top-notch customer relationship and service.

“Visitors will be impressed by astonishing product selection of Flagship Tokyo unrivaled in the music products industry. They include unique instruments crafted by master builders, a lot of models manufactured in U.S., Japan and Mexico, exclusive products only available at Flagship Tokyo and lifestyle products.”

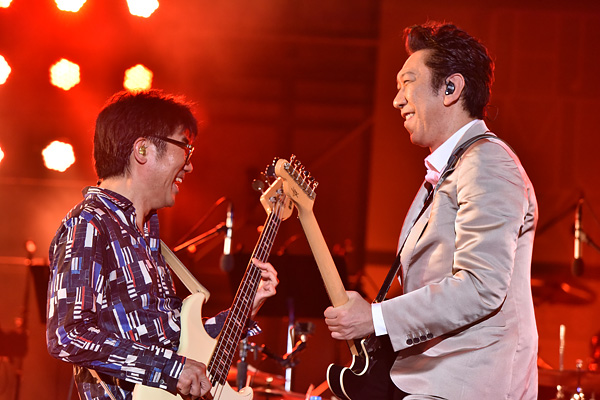

The opening remarks were followed by talk sessions and live performance featuring Ken, J, MIYABI, Hama Okamoto and other name Fender artists.

The store has 1,056 sq. meter space fully packed with Fender products. The 1st floor with spacious entrance is allocated for new and limited-edition models, F IS FOR FENDER wearables as well as fashion and lifestyle products.

The 2nd floor offers popular electric guitars, basses and amps made in U.S. and Japan, and perfectly sound-controlled Fender Amp Room. The models offered by Fender Custom Shop are exhibited on the 3rd floor.

The basement has space for acoustic guitars and ukuleles which is occasionally used for live events. Also, adjacent Fender Café serves fine coffee in collaboration with California-based Verve Coffee Roasters.

Fender Flagship Tokyo: Jingu-mae 1-8-10, Shibuya-ku, Tokyo 150-0001 https://www.fender.com/ja-JP/fender-flagship-tokyo.html

July New Product Launches

Yamaha NP-35B /WH, 15B/WH digital pianos

https://www.yamaha.com/ja/news_release/2023/23060601/

Korg Pa5X arranger keyboards (61-key, 76-key, 88-key models)

https://www.korg.com/jp/products/synthesizers/pa5x/index.php

Korg wavestate mkII synthesizer

https://www.korg.com/jp/products/synthesizers/wavestate_mk2/

Korg wavestate SE and SE Platinum synthesizers

https://www.korg.com/jp/products/synthesizers/wavestate_se_platinum

Hammond XK-4 electronic organ

https://www.suzuki-music.co.jp/products/65781/

Roland E-X10 arranger keyboard

https://www.roland.com/jp/products/e-x10

Pearl Flutes Maesta F-MD925/E-55J 55th Anniversary Models

https://pearl-music.co.jp/flute/products/6360/

Edwards electric bass

https://espguitars.co.jp/products/edwards

Steinberg DRICO PRO/R, DRICO PRO-CG/R, DRICO PRO/E, DRICO PRO/CG/E、DRICO EL/R and DRICO EL/E music production software

https://www.yamaha.com/ja/news_release/2023/23052501/

Yamaha DM7, DM7 Compact and DM7 Control digital mixers

https://www.yamaha.com/ja/news_release/2023/23060701

Roland VR-400UHD AV mixer

Roland Pro A/V - VR-400UHD | 4K Streaming AV Mixer

ESP PA-LS08 Best of Luna Sea 2023 Sugizo guitar picks

https://espguitars.co.jp/productinfo/32978

2023 First-half Term Music Products Retail Market Survey: 33 Music Retailers Throughout Japan Participate

Japan Music Trades recently conducted annual 2023 Music Retail Market Survey for 6 months from January through June with help of 33 music retailers throughout Japan. It reveals that 81.8% of the music retailers reported that the sales during the term had increased far greater than the last year survey of 57.5%. Consequently, only 9.1% each music retailers reported that their sales went down or unchanged.

The 2022 survey showed 30% of the participated music retailers reported business decline, and 12.5% reported no change. The 2023 survey result apparently tells that the industry experienced a definite upswing from the Covid-19-related stagnant economy.

As the economic recovery has been much talked since last year after the Government lifted restrictions against corona virus, public events restarted, and music retailers saw heavy customer traffic. Not a few retailers reported that people movement dramatically changed after Covid-19 was classified into Class 5 Infectious Diseases, looser regulations this past May.

Music retailers reported that sales of electric guitars and basses significantly increased inspired by popular animation movie. Wind instruments severely impacted by Covid-19 also showed the largest recovery in the last 4 years. While the school music retailers fretted shortage of products supplied by manufacturers and distributors.

As to the most prospected marketing strategies for latter half of the year, 45.5% of the retailers pointed upgraded customer relationship and communication capability at sales floor which were more than 25% increase over the survey last year. 37.5% music retailers were apparently most interested in holding live music events the previous year. A year later, their expectation turned to expanding business opportunities like developing entry level market and practically seeking effective ideas to boost sales through carefully planned promotional events. They are also expecting upgrading inventory, development of products designed in collaboration with third parties, and searching new generation of promising products. Not a few retailers also expressed increasing interest in expanding distribution of used instruments.

Music Store Sales Staff Awards 2023 Application Opens

Japan Musical Instruments Association (JMIA) opened ballot application on June 29 for Music Store Sales Staff Awards 2023, the 3rd consecutive event initiated in 2021. At the pre-meeting held online on June 14, JMIA announced that a new ballot category, “Contents Production Award” was added.

The award aims to increase awareness of the music products industry to public and promote pleasure of music making. Last year, the event drew 4,300 ballot applications from music store sales staff, and 29,000 from general public which doubled from the year before last. Five winners of the Products and Artists Awards were invited to the award presentation ceremony held at Yamaha Ginza Studio last October.

Last year, the awarded products contributed to help boost sales of music stores with special store display and talks about the awards with customers during the year-end business season.

The 2023 Award included 5 product categories of digital piano & keyboards, guitars, basses, flutes, and violins, 6 artist categories of pianist, guitarist, bassist, flutist, violinist, most-entertained artist of the year, and the new contents production category (novels, animation programs, movies, cartoons and TV dramas related to musical instruments).

The top 3 products and contents production artist categories awards are chosen by vote of music store sales staff, and the award presentation ceremony will be given to Grand Prix Award winner. The top 5 artist awards will be nominated by music store sales staff voting, and then the Grand Prix Award will be decided by public voting.

The application for music store sales staff was closed on July 3, and the Grand Prix Award presentation ceremony takes place on October 23 at Yamaha Ginza Studio.

June New Products Launch

Aria Legend LPB-Z WH electric bass

http://www.ariaguitars.com/jp/items/electric-guitars/legend/#Basses/

Aria SPS-1900UKE ukulele strap

http://ariaguitars.com/jp/items/accessories/strap/ukulele/sps1900uke-nb/

Boss SDE-3000, SDE-3000EVH digital delay effects pedals

https://www.boss.info/jp/categories/effects_pedals/delay_reverb/delay/

ESP electric guitars-VULTURE James Hetfield Olympic White, THE CRYING STAR-7 GALNERYUS/SYU, AMAZE-CTM FM/M, AMAZE-CTM-SL5 FM/M

ESP LTD KH-V Kirk Hammett electric guitars

ESP Killer Guitars KG Exploder II BIB

https://espguitars.co.jp/products/esp

Famous FS-S10, FLS-5GC, FLS-11GC, FT-1G, FT-5G ukuleles

https://www.kiwayasbest.com/shopbrand/001/o/

Galax Ura U Model English horn reed

Roi flute head wing and flute master cleaner II

http://www.global-inst.co.Jp/

Kawai digital pianos-CA501 & CA401

https://www.kawai.jp/product/c/digitalpiano/caseries/

Korg microKORG Crystal synthesizer

https://www.korg.com/jp/products/synthesizers/microkorg_crystal/

Roland AIRA Compact Series S-1 synthesizer

https://www.roland.com/jp/categories/featured_products/

Yamaha Clavinova CVP-909PE, CVP-909B, CVP-905PE, CVP-905B digital pianos

https://www.yamaha.com/ja/news_release/2023/23051001/

Yamaha WS-B1A compact speaker

https://www.yamaha.com/ja/news_release/2023/23051101/

Two Leading Music Stores Open Outlets Outside Home-ground

T. Kurosawa & Co., Ltd., Tokyo

One of the leading music store chains in Japan, T. Kurosawa & Co., Ltd. operating 20 outlets in Tokyo area opened its first store in Kyushu on April 28. Located on the 8th floor of Fukuoka Mina Tenjin, a brand-new 2,310 sq. meter shopping complex connected with adjacent North Tenjin shopping complex, the new Kurosawa store has access from nearby two metro stations.

The largest level sales floor space among the Kurosawa outlets showcases 1,200 fretted instruments including Fender and Gibson guitars, staff-selected GEN custom order guitars, vintage and used models, the largest selection of C.F. Martin guitars in Japan, a host of domestic-made and imported acoustic guitars, ukuleles and classical guitars. A good selection of amps, effect processors and guitar-related accessories can meet the needs of every guitarist. High quality on-sight repair services by seasoned professional are also provided at the store.

Kazuhiro Okazaki, manager of Kurosawa Gakki Fukuoka Mina Tenjin Store commented, “Many visitors are very pleased that Kurosawa opened the first store in Kyushu. Hakata is known as a music city with a huge base of music makers.

As we have more than expected positive responses, we expect to build trust of local customer and can grow to be a competitor with Kurosawa’s bigger outlets in Ikebukuro (Tokyo) and Nagoya.

Miki Gakki Co., Ltd., Osaka

Osaka-based Miki Gakki Co., Ltd., another leading music store chain opened Smalls guitar shop in Ochanomizu, Tokyo, on April 28. As the store name tells, the cozy shop has taken the first step in Tokyo area at the center of Ohanomizu known as musical instruments town, only 4-minute walk from Japan Railways and Tokyo Metro Ochanomizu stations.

Yoshihiro Ueno, store manager says, “We have planned to open our outlet in Tokyo for the past years. The timing was perfect as we mark 200th anniversary in 2024.”

The shop looks to be a comfortably furnished hideaway for guitarists having about 100 electric and acoustic guitars including coveted vintage models and precious original models by name luthiers collected by the sales staff from the various parts of the world.

There is a spacious service section on the 2nd floor to meet the needs of repair and maintenance works as well as a meeting room for instrument selection and talks for customers and sales staff.

Ueno concluded, “We were off to a good start having inquiries even before the opening and excellent customer flow. More than anything else, we are happy to know that quite a few visitors know Miki Gakki here in Tokyo. We are looking forward to offering customers really valuable instruments regardless of their price range.”

Obituary: Yukio Sakurai (1939 – 2023)

Yukio Sakurai, former president of Japan Music Trades passed away on May 2nd at the age of 83.

Sakurai was nephew of Rikuro Hiyama, founder of Japan Music Trades, and joined the publishing house at the very beginning as a staff photographer and sales staff. He assumed the presidential position from Hiyama in 1990. During his 20 years tenure at Japan Music Trades, he took leadership at the publisher, and contributed to the growth of the music products industry.

A good-natured man, he was much loved for his friendly personality by both young and veteran industry people.

May New Products Launch

*Aria SPS-2400RA guitar strap http://www.ariaguitars.com/jp/items/accessories/

*Casio exclusive bench for Privia digital pianos http://casio.jp/emi/

*ESP Grassroots G-SN-45DX Fuji Purple electric guitar, PA-MA10-25th SEX MACHINEGUNS and PA-MSG10-25th SEX MACHINEGUNS guitar picks

https://espguitars.co.jp/productsinfo/321621/

*Kawai Mini Piano-GP-44 44-key grand cabinet model

http://s:toys-onnlineshop.kawai.co.jp/

*Korg Liano digital pianos

https://www/korg.com/jp/products/digitalpianos/liano/#colors

*Pearl 170H/3(Yuya) , 180H/2(Kid’z) Drumsticks

https://pearldrum.com/ja/products/drumsticks/

*Roland VR-6HD Intermediate class AV mixer

https://www.proav.roland.com/jp/categories/featured_products

*Boss Gigcaster 8 and Gigcaster 5 streaming mixers

https://www.boss.info/jp/products/gigcaster_8/

*Roland TMC LKM68 genuine leather guitar strap

http://www.tmc-liveline.co.jp/

*Yamaha b121TC3 and b113TC3 TransAcoustic upright pianos and RSC3-1, RSC3-3, RSC3-5, RSC3-10 and RSC3-30 Silent Piano sound control units, VSH3-1, VSH3-2, VSH3-3, VSH3-10 and VSH3-20 Silent Piano Upgrade sound control units

https://www.yamaha.com/ja/news_release/2023/23041404/

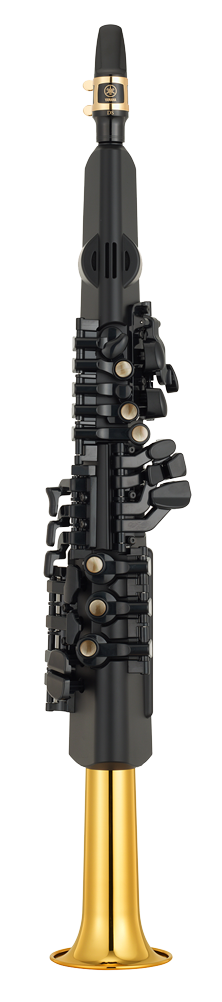

*Yamaha YDS-120 digital saxophone for entry level player

https://www.yamaha.com/ja/news_release/2023/23041403/

*Yamaha SB7J, SB6J, SB3J, SB2J, SB1J and Silent Brass trumpet/cornet, flugel horn, trombone, horn, euphonium and tuba and STJ Personal Studio

https://www.yamaha.com/ja/news_release/2023/23041402/

*Yamaha FG9R and FG9M acoustic guitars

https://www.yamaha.com/ja/news_release/2023/23041301/

*Yamaha DM3 and DM3 Standard light-weight compact mixers

https://www.yamaha.com/ja/news_release/2023/23040702/

**Yamaha YH-WL500 wireless headphone

https://www.yamaha.com/ja/news_release/2023/23041401/

Yamaha, Roland and Casio Products Won 2023 German iF Design Awards

iF Design Award 2023 announced recipients of this year’s Product Design and Professional Concept Awards, and IF Design Award. Yamaha TW-E7B true wireless Bluetooth earphones and Stepping Out of the Slate design concept models received the Product Design and Professional Concept Awards, respectively. TW-E7B also received German Red Dot Design Award Product Design 2023.

Roland T-8, J-6, E-4 AIRA Compact Series digital instruments, F107 digital piano as well as matched Roland Piano App, BRIDGE CAST gaming audio mixer won both iF Design Award 2023 and Red Dot Design Award 2023.

Casio Privia PX-S7000 digital piano received Gold Statement Award of iF Design Award 2023.

Ikebe Music Opens Tokyo’s Largest Used Instruments Shop in Shibuya

Ikebe Music opened Ikeshibu Reuse, a flagship store of its Ikebe Reuse, a buy back and sell service division of used musical instruments on April 1 in Shibuya.

Ikebe Reuse was launched in April 2021 under the corporate slogan “Pass along good used instruments with emotion and story to new user”. Since then, high quality maintenance skill and long-term product warranty of the division have successfully attracted attention of customer. Ikeshibu Reuse serves as an upgraded unit integrating Ikebe Reuse opened at the new location of Shibuya shopping district.

Ikeshibu Reuse offers around 400 used guitars and basses from middle class to high-end models, the largest inventory in Tokyo, all inspected and fine-tuned by veteran technicians, at more than doubled floor space. Customer can select favorite instruments in an inviting setting.

Closely located to Ikeshibu new instrument music shop, it allows customer to compare new and used models all at once.

It also has a reception desk for buy back order, come to customer home service upon request as well as consultation and product assessment.

Shoki Takei, manager of Reuse Business Unit says, “We see customer is more positive than ever to buy used instruments as their first choice these days. We expect that Ikeshibu Reuse becomes the first place that customer of all ages visits as we offer the market a complete cycle from selling new instruments, providing buy-back service, and selling them again as reuse models after repair and maintenance services done.

Yamaha Launches Distribution Subsidiary in The Philippines

Yamaha announced that it had recently opened Yamaha Music Philippines Inc., a local distribution subsidiary in Makati City, in Metro Manila business area. The country is one of the growing markets in the world. Koichiro Onoye is responsible for the unit and the new company starts operation in October.

April New Products

*Roland GP-9M, GP-9 and GP-6 digital grand pianos (http://www.roland.com/jp/categories/featured_products/)

*Kawai Mini Pianos for children (White and Red online exclusive models joined) (https:/toys-onlineshop.kawai.co.jp/view/)

*Yamaha CK61 and CK88 Stage Keyboards (https://jp.yamaha.com/products/music_production/stagekeyboards/)

*Roland SH-4d synthesizer (https://www.roland.com/jp/products/sh-4d)

*XO 1650D, 1651D and 1651 ND French horns (http://www.global-inst.co.jp/)

*Pearl 189H Drum sticks (https://pearldrum.com/ja/drums-news/24263296)

*Killer Guitars KG-Exploder Musha ’22 electric guitar (https://www.killer.jp/guitar/kg-exploder-musha-22.html)

*Lakeland SL44-60/R Hinach Hidekazu Hyuga model electric bass (https://espguitars.co.jp/lakland/artists/hidekazu-hinata/?series=shoreline&model=SL44-60/R%20Hinatch%20Signature%20Bass&variation=lake_placid_blue_/_mh)

*Edwards E-SNAPPER-AS/M (https://espguitars.co.jp/product/20009/)

Fender Opens First Flagship Store in Tokyo

Fender Musical Instruments and Fender Music(Japan) announced that Fender’s first flagship store in its history would open this summer in Harajuku-Omotensando, fantastic shopping area in Tokyo.

Fender Flagship Tokyo is designed to offer every type of musicians from professional to first-time guitar player and music enthusiasts, even no music makers remarkably exciting shopping and musical experience. The area is known as a source of fashion and culture.

It shares 4 floors from basement to the 3rd floor of THE ICE CUBES building where all Fender and Squire electric guitars and basses, acoustic guitars including the latest artist signature models, Fender Custom Shop TM custom-order models, amps and pedals as well as accessories and lifestyle products.

It shares 4 floors from basement to the 3rd floor of THE ICE CUBES building where all Fender and Squire electric guitars and basses, acoustic guitars including the latest artist signature models, Fender Custom ShopTM custom-order models, amps and pedals as well as accessories and lifestyle products are displayed.

2022 Japan Musical Instruments Production, Domestic Sales, Import & Export

Production(sales) and Export Value of Piano Increased

According to the production/sales statistics compiled by The Ministry of Economy Trade & Industry, a total of 43,000 units of acoustic upright and grand piano (2% less than the year before last) were distributed in Japan and exported last year. However, they achieved 30.9billion yen sales, 12% more than the year before last.

The statistics of Shizuoka Pref. Musical Instruments Manufacturers Association, to which good percentage of leading musical instrument manufacturers in Japan belongs precisely coincides the figures above mentioned. In 2022, 13,947 units of acoustic piano worth of 8.2billion yen were sold in Japan and 29,014 units worth of 22.7billion yen were exported. When compared with the results in 2021, domestic sales increased 12% in units and 10% in value. While export of acoustic piano decreased 7% in unit but increased 12% in value.

Piano market revived in 2021 from the COVID-19 pandemic with a significant 20% and 31% increase in the domestic market and export, respectively. A year later, export of them slightly declined in unit. But they went up in value. It’s safe to say that manufacturers shifted production to upper class models. Also, they raised price of the products to cope with cost increase in materials and distribution.

There might have been another reason for the brisk domestic sales of piano. Yamaha and Kawai raised retail price of piano in April and October, last year. That could have stimulated demands of customer for largely inexpensive models as a last-minute purchase before price hike.

The statistics by The Ministry of Trade, Economy and Industry shows that distribution and export of digital pianos and electronic organ were the same level of 2018 before the pandemic with 5% and 3% fewer sales in units and value, respectively. The dramatic surge of demands during the pandemic looks dried up.

Electronic keyboard market kept the downward trend to the historical level in units, and to 50% level in 2012.

Manufacturers raised price of products to cope with soaring materials and distribution cost, and it affected domestic sales of wind instruments with 15% down in units, acoustic and electric guitars with 10% down in units, but export value rose 15% and 5%, respectively.

Export Exceeds 80billion Yen, Largest In 21 Years

Total export value of the musical instruments increased 16% over the previous year to 87.8billion yen according to the statistics compiled by The Customs and Tariff Bureau of Ministry of Finance. Pianos shared about 50% of the total value. Grand piano value increased 17%, but upright piano value ended with a minimum 1% increase.

Export of electric guitars, reed instruments and other wind instruments, and brass instruments advanced 38%, 23% and 53%, respectively. Piano parts and accessories also increased 28%.

Total import value of musical instruments rose 20%. Electric/electronic instruments with keyboard, electric guitars, parts and accessories of instruments other than those for piano are the 3 largest segments with 30%, 33% and 37% increase, respectively. Parts for piano and accessories increased 35% as well.

Hand-held Sound Control Unit Developed by Professional Singer

Simply attaching to a microphone, Voicease provides vocalists with sound control capability with no worry of playing time and place.

Taro Kijima, associate professor at College Choir, Kunitachi College of Music, and gospel musician started development works of simple sound control unit for vocalist, and launched it into production having raised 14 million yen through crowdfunding last year in the midst of the COVID-19 pandemic.

Kijima says, “Singing is a principal human nature like eating and sleeping. But we cannot sing at midnight without bothering family members and neighbors. Build a sound control capsule in a room? It’s costly. I have sought after a solution in the last 20 years. The pandemic made all doors of studios and karaoke bars shut down. All members of my choir group lost stage to sing. One of them even gave up singing. Necessity is mother of invention. I put up my ideas I have kept in mind for the years to develop a simple sound control unit for vocalist.”

It was very fortunate for him that he happened to get acquainted with Naoko Horiguchi, owner of Aria Music Offfice, a company designing and manufacturing music-themed goods, stationery and accessories. Inspired by Kijima’s ideas, Horiguchi and her development team started research, designing and production of prototype.

The largest feature of Voicease is sound monitoring capability which allows vocalist to discern own voices while reducing sound level by more than 20dB. The quality level of sound control is good enough to satisfy requirements of professionals.

Kijima explains, “Voicease is an exclusive vocal sound control unit never existed before as it covers both mouth and nose of vocalist. When only mouth is covered with a conventional sound control unit, it’s hard for vocalist to discern quality level of his or her voice.

In addition to excellent sound control capability, Voicease provides vocalist with fine air ventilation for comfortable breathing, collects tones coming through nose, and absorb sound inside the unit. It is also lightweight to be held by a single hand, and compatible with versatile microphones.

Horiguchi adds about quality of Voicease, “We have worked with help of professional vocalists as we knew that they would not approve the unit unless they are contented with the sound control capability. We are proud of Voicease which can meet every requirement of vocalist.”

Voicease won instant appreciation among VTubers who love the unit at midnight live streaming. Their comments helped increase demands on versatile scenes including DTM music production, Yamaha SYNCROOM session and Karaoke bar.

Currently, Voicease is distributed on the internet. But sales through physical music retail channel are expected to grow as inquiry from them increases. Kijima concluded, “We are very pleased that sound control unit for vocalist finds a market far larger than we expected. Voicease can serve the needs of stress-free singing in broader occasions of the society.”

Limited Edition Mick Jagger (The Rolling Stones) Harmonica

Limited edition Mick Jagger brand major diatonic key harmonica (49.99 STG pounds retail) is now exclusively distributed by whynow Music (https://whynowmusic.com).

The harmonica is a combination of sound quality and design of Lee Oskar (built by Tombo Musical Instr. Co., Ltd., Tokyo) with the musical know-how of Mick Jagger. It is available in 10 major diatonic keys and comes with a Mick Jagger exclusive case.

There is no plan for distribution of the instrument in the Japanese and overseas markets through the conventional music distribution network as of this writing as they are exclusively manufactured for whynow Music.

Jaggar says, “It’s an exciting news! I expect that the harmonica is loved by future generations of promising young artists.”

Lee Oskar shared, “It’s my great honor that such a legendary artist like Mick chose us as a partner in developing the harmonica.”

March New Products

Roland FP-E50 portable type digital piano (https://www.roland.com/jp/products/fp-e50/)

Saito SCL27 Claves (https://www.nonaka.com/saito/claves.html)

Aria Pro II 615-GH electric guitar, 714-AE200LTD, 615-AE200LTD acoustic-electric guitars (http://www.ariaguitars.com/jp/topics/)

Yamaha AG08 Live Streaming Mixer (https://www.yamaha.com/ja/news_release/2023/23012601/)

Roland VMH-D1 V-Moda digital drum headphone (https://www.roland.com/jp/products/vmh-d1/)

BEESMAN “Wood Balm” wax (https://www.instagram.com/reel/Cn68QRBPbEh/)

February New Products

Aria Pro II 212-MK2, PE-AE200 electric guitars, APE-100 electric acoustic guitar, STB-AE200 electric bass, SPS-2000 & SPS-2000FF3 guitar straps (http://www.ariaguitars.com/jp/topics/)

Boss KATANA-50 Mk II EX & Cabinet 212 WAZA guitar amps, KATANA-Artist Mk II amp head (https://www.roland.com/jp/news/1012/)

Edwards E-SNAPPER AL/R & AS/M electric guitars (https://espguitars.co.jp/productinfo/30619/)

ESP SNAPPER-7 Morioka Custom “Red Garnet” 7-string electric guitar, CL-28 Poppin’ Party CLOTH & CL-28 Roselia CLOTH wipe cloth, PA-LS08-2022 LUNACY (SUGINO), PA-VH15 (HIKAZU), PA-VT15 (TERU) & PA-VM10 (MASASHI) picks (https://espguitars.co.jp/news/)

Killer KG-Fascist Vice II electric guitar (http://www.killer.jp/guitar/kg-fascist-vice-ii.html)

Roland GP-3 compact digital grand piano, TD-02KV, TD-02K digital drums, BRIDGE CAST gaming audio mixer (https://www.roland.com/jp/company/press_releases/2023/)

Yamaha STAGEPAS-200 & 200BTR portable PA system (https://www.yamaha.com/ja/news_release/2023/23011801/)

Kawai Ryuyo Factory Installs Green Energy System

Kawai installed solar electric power facility at its Ryuyo factory in Shizuoka Pref. where Kawai grand and upright pianos are manufactured as part of an important project reducing environmental load. Operation started on Dec. 23, 2022.

Having a total of 3,352 sq. meter space using 1,542 solar panels, it supplies 781 MW electricity per year, about 18% of total electricity consumption of the factory.

Thanks to green energy system, the company spokesman commented that the factory effectively reduces 245 tons of CO2 output a year. Ryuyo factory is the first case in the company installing green energy system.

Yamaha Ranked 2nd Highest on Corporate Communication Site User Survey

Tribeck Brand Strategies, a thinktank of Tribeck Inc. which provides clients digital marketing services, DX platform, experience & management, media/advertising agency announced 2022 user survey ranking of corporate communication sites of 252 leading companies in Japan. The corporate sites were judged by 6 factors; 1. Corporate messages, 2. News releases, 3. Technological information/corporate approaches to product quality, safety and security, 4. Approaches to sustainability/corporate social responsibility and environment, 5. Investor relationship, 6. Corporate philosophy & vision.

Yamaha’s ranking has gone from 13th the year before to 2nd this time. User highly praised the company’s approaches to sustainability, corporate social responsibility and environment.

Suntory Corporation, food and beverage manufacturer was the highest ranked, and Yamaha was followed by Shiseido, Fuji Film Holding, Kao, chemical and textile manufacturer.

2022 Retail Music Market Survey

Nearly 40% music retailers reported sales increase

Japan Music Trades recently conducted an annual retail music market survey sending a questionnaire to 151 music retailers nationwide. In 2022 retail music business slowly returned to the pre-pandemic level as the restrictions of travel eased in March, and restaurants and shopping malls extended opening hours in and after the May holiday season. After Japanese government lifted immigration restrictions in October, number of overseas travelers dramatically increased.

All these changes and movements worked for retail music business. Nearly half of responded music retailers reported sales increase over the year before last.

Looking sales by product category, grand pianos electric guitars and in-store music teaching for adults showed excellent performance last year. It is likely that last-minute surge in demand before price hike pushed up sales of expensive musical instruments. Yamaha and Kawai raised retail price of their grand pianos in April and October, respectively, to cope with price increase in raw materials and logistic costs.

Sales growth of electric guitar were largely attributed to increasing demands from professional musicians as live music events resumed. In addition, a popular TV animation program “Botch, The Rock” attracted interest for electric guitar and bass among young generations.

While, more than half music retailers reported sales of upright pianos and digital pianos went down in the year. Enrollment of music teaching studio significantly dropped in 2020 by the pandemic. Demands for learning to play musical instrument revived in 2021, but new enrollment did not reach the level of the previous year.

Business prospects for 2023

The music retailers expect 2023 business to remain unchanged (44%), better (29%), and worse (27%) over the previous year, more positive than the last year survey. They are optimistic in keeping business that people have better accessibility to social events, performance stages and other music-related activities. They also expect further recovery of general economy which will increase demands for music making among people of all generations and growth of overseas travelers visiting Japan.

On the other hand, they are worried about store traffic affected by new variants of COVID-19, continuing price hike of products and possible delay of manufacturer shipment.

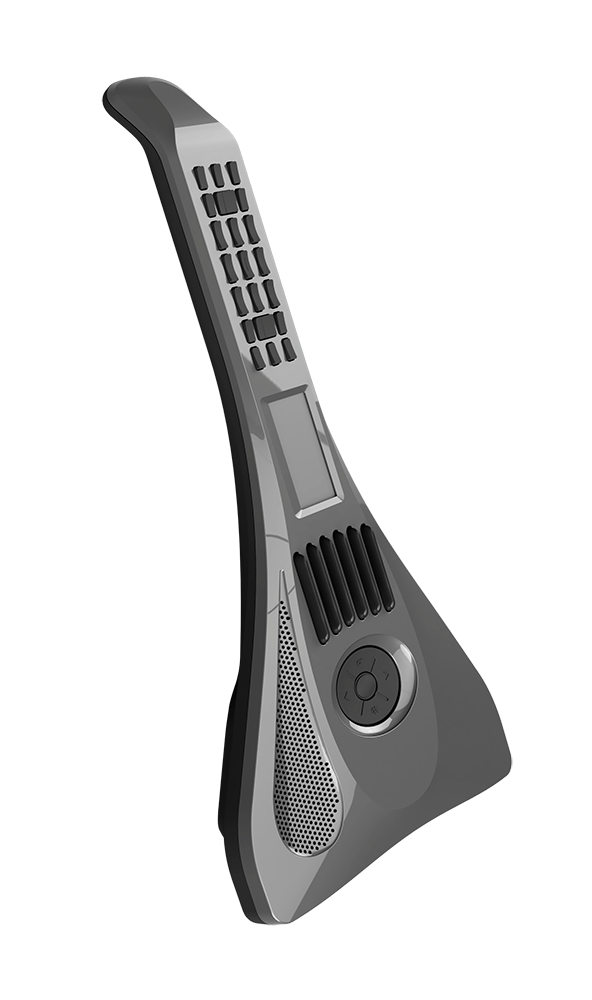

InstaChord, a New Innovative Electronic Instrument

An easy to use, but full-blown musical instrument named InstaChord is now distributed at music store chains.

Born in 1975 in Hiroshima, Yuichi Nagata, musician (vocalist), but not good at playing musical instrument, web programmer, advertisement producer, invented the instrument for first time music makers and those guitarists given-up to play. He started commercial base production of the instrument raising 80 million yen far exceeding his original plan of 50 million yen by crowdfunding in 2020.

InstaChord is based on a special chord entry interface using 2 fingers Nagata developed to help his music composition. Then, after a detailed market survey, Nagaya found there was a big market for musical instruments everyone can play without any musical knowledge and experience.

He began direct sales of InstaChord to customer via internet in 2021. To this day, total sales have reached 6,000 units with 200million yen value.

Nagata says, “I wanted InstaChord to be well accepted and keep selling through ordinary music distribution channel in the market in the years to come. So, I never thought of discount sales, nor special offer at reduced price for the benefit of the investors. I’m so grateful more than expected number of people shared my idea and offered financial support. It’s great.”

InstaChord is sold at music stores besides direct sales on the net from last November. A retail sales staff comments, “It’s not a gadget-type instrument”. Another staff says, “InstaChord is an authentic music gear”.

InstaChord comes in a futuristic guitar shape body equipped with control buttons on the neck, and 6 rubber pads likened to guitar strings on the body. Sound is produced by simply pressing a control button to which a chord is assigned and strum rubber pad with left hand. The control buttons are the key to the performance system. Just select desired key of a tune, diatonic chords are automatically assigned to the control buttons numbered from 1 to 9 on the panel. For instance, in II-V-I (two-five-one) chord progression, simply press number 2, 5 and 1 buttons.

In addition to the chord number buttons, it offers Swap button for selection of major or minor keys, b-button which delivers lower half-note, 7th, sus4 and aug(augment) buttons to be pressed together with chord number button.

It provides players with not only versatile music performance but also understanding chord theory.

Nagata explains, “The assigned chords are fixed and cannot be customized by player. It is easy to assign chords in serial number following melody flow, but it is simply a gadget, no longer a musical instrument. I think it is a logical interface for musical instrument that everyone can play music in the same fingering.

“The rubber pads are also important component of the instrument. Player can feel the joy of playing guitar stroking pads with his right hand. It means stroking timing, sense of rhythm and other technical factors are well reflected on performance. Anyone can make musical sound from the very beginning, but as he advances after practices, he can feel pleasure of making music just like he plays guitar.”

Having a battery, speaker, and USB and Bluetooth MIDI compatible capabilities, InstaChord works as a MIDI controller in music production and sound recording as well.

Since it changes chords to scale degree in performance, conventional sheet music can be used simply adding scale degree to each chord. Also Nagai developed a special app automatically changing chord chart to scale degree.

Nagata remarks that the main users of InstaChord are the first-time player with no musical experience and seniors given up to keeping playing guitar. “They are all happy with InstaChord. It is excellent seeing the people never imagined of playing guitar before are enjoying music making!”

InstaChord is increasing exposure on YouTube and other social media recently. User base will expand as distribution through traditional music retail network begins, and new customer will explore unique approaches to enjoy InstaChord.

Nagai expects the true characteristics and capabilities of InstaChord will be best felt by touching and experiencing it at the sales floor of music store. He believes it is a unique music gear even seasoned and serious musicians can enjoy.

Contact Yuichi Nagata

https://instachord.com/instachord-english

6 Music Retailers Talk: New Year Holiday Season Sale

“Guitars, especially electric models have sold well these couple of months. Vintage and custom models as well as artist signature gears are moving well. Imported models have significantly increased shares as shipment level recovered in the fall. It is great seeing sales grow under our business policy, ‘Sell products with true value at appropriate price.’ “Overall business environment is likely regaining the pre-pandemic conditions. On the other hand, our inventory volume is growing. It is a matter of better control of sales and inventory balance. One notable phenomenon in sales is soaring demands overseas. As travel restriction is eased, more tourists from outside Japan visit us lately. More than that, we see increasing cross-border online sales via reverb.com. Weaker yen attracts more foreign customers. We hope the trend continues. “The year-end/new year holiday season approaches, we have sizable number of customers searching gears to buy with bonus on weekends. “We expect good selection of products and well-planned inventory will contribute to the business.”Kazuo Mitsugi, Store Manager, Kurosawa Gakki G-Club Shibuya, Tokyo

“After a new store built past April, we operate sharing 2nd and 3rd floors of our building. Since the former store stood facing the street, it took us a little time to adapt to the new floor plans. “After April, we feel more serious customers visit us than before. In the past we had not a few first time visitors dropping in and strolling the sales floor. The new customers typically select high-ticket bizen works, Höfner and Rickenbacker instruments. During the pandemic, they started to come to us after getting information on internet and online video. As a specialist store of high-quality original guitars, we always keep showing video on products on our website as we understand serious customer needs information. “Our main customer base is 40s and over male adults and married couples. Customers from overseas are increasing now, but we will see more of them come to us in months ahead. “We started year-end/new year sales campaign in the end of November, around the Black Friday. Recent price hike of every product has been a challenge for us, but we keep our policy, ‘Provide customers with value-added products’.”

Tatsuki Moda, Store Manager, Miyaji Guitars Kanda, Tokyo

“We feel sales of wind instruments are slowly coming back. As a shop specialized in flute, we have an exclusive salon for flutist to better serve the local flute community. As its awareness increases, we see more customers visit or call us these days. “Given that number of symphonic band student is declining, it is hard to recover the school market before the pandemic. While adult player is increasing, and business is brisk. We expect to enhance sales campaign in collaboration with our brass instrument specialist store, Wind Crew, in Shin-ohkubo, Tokyo for the coming best season. “The COVID-19-related restrictions are loosened, we see visitors from overseas countries are increasing, though they largely stop by for CD and score. Hopefully the customer searching musical instrument follows in coming months. “We are carrying a massive sales campaign from the beginning of December putting emphasis on single different category every week. We have also realigned the piano floor with additional units displayed for easy experiment and comparison. “After experiencing a host of irregularities during the pandemic, we feel the business environment is nearly returning to the level of 3 years ago. It is my hope that the year-end/new year sales season further pushes up our business.”

Takashi Obara, Store Manager, Yamano Gakki Ginza Main Store, Tokyo